Notes from the Field: The New York State CDFI Coalition's 2019 Annual Conference

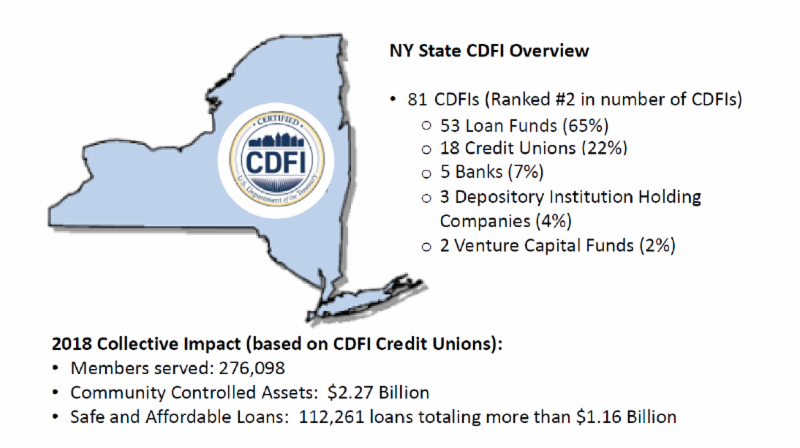

On May 7th, Community Development Financial Institutions of all stripes convened in Albany, NY, for two days of workshops and panels at the New York State CDFI Coaltion's 2019 Annual Conference. Inclusiv is a founding member of the Coalition, one of the oldest and largest state CDFI Coalitions in the country, and serves on its board of directors. The state of New York has one of the highest numbers of CDFIs with 81 certified institutions, including 18 credit unions. In addition to the many Inclusiv members and partners in attendance at the conference, Inclusiv staff members Jules Epstein-Hebert, Cathi Kim, and Pamela Owens participated in the event.

A tone for the conference of collaboration was set with welcoming remarks made by the Coalition's Board Chair Linda MacFarlane, of Community Loan Fund of the Capital Region, and a keynote address by Dr. Havidan Rodriguez, President of the University at Albany. Dr. Rodriguez focused his remarks on the potential opportunities for partnerships between CDFIs and universities in finding innovative solutions to address the challenges faced by underserved communities. He also pointedly mentioned relief and storm-preparedness efforts undertaken by University students in Puerto Rico in the wake of Hurricane Maria. Collaborations between CDFIs and community partners, including Inclusiv's resiliency initiatives with Puerto Rican cooperativas, were also highlighted by Dr. Adrian Franco of the Federal Reserve Bank of NY during opening session "CDFIs: Catalysts for Equitable Growth."

Inclusiv's own Cathi Kim, right, is joined by John Felton, CEO of Southern Chautauqua FCU, and Melanie Stern, Director of Consumer Lending at Spring Bank, for a panel discussion on the "Benefits to Being a CDFI" (image courtesy of NYS CDFI Coalition)

Jeanique Druses of JP Morgan Chase Global Philanthropy, Christine AuYeung with the Robin Hood Foundation, and Sabrina Stratton at Amalgamated Bank took the stage for a conversation on "Investments to Combat Income Inequality" moderated by Kim Jacobs, President & CEO at Community Capital New York.

The final plenary of the day was moderated by Matt Tipple of JP Morgan Chase & Co. and was on the "Benefits to Being a CDFI." Panelists for this conversation included Cathi Kim, Director of Inclusiv/Capital, John Felton, CEO with Southern Chautauqua FCU, Melanie Stern, Director of Consumer Lending at Spring Bank, and Hubert Van Tol, President of the PathStone Enterprise Center. The discussion was complemented by Cathi Kim's presentation on New York CDFI trends and the call for diversity and inclusion in the CDFI industry.

“Though home to Wall Street, more than 24% of New Yorkers are either unbanked or underbanked. New York CDFIs bridge these financial access gaps. In 2018, New York’s CDFI credit unions served 276,098 members and invested $1.16 billion in the form of safe and equitable loans to the community. It’s this purpose driven foundation of CDFIs that define our impact in terms of the double-bottom line. Our collective success is shaped by our accountability to the communities we serve that also call us to diversity, building equity and strengthening inclusion,” said Cathi Kim, Director, Inclusiv/Capital.

Find Cathi Kim's presentation on New York state CDFI trends here.

The first day concluded with a networking reception featuring Inclusiv's former CEO Cliff Rosenthal's book, Democratizing Finance . The book details the history of the CDFI movement and the genesis of the Fund.

Day 2 led with a focus on workshops and sharing solutions. Topics included "Investments for Aging Housing Stock," “How New York State Can Fight Predatory Lending,” "Attracting Innovative Investment in Small Business," and "FinTech Fixes to Policy Problems."

During the "Investments for Aging Housing Stock" workshop, panelists discussed the affordable housing shortage in New York state. Solutions included taking advantage of the so-called "zombie laws" wherein banks or owners of vacant building are required to maintain the buildings' upkeep, as well as establishing community land trusts. Community land trusts are structured so that the trust owns the land and a home-owner owns the structure that sits on the land.

During a brief pause in learning and networking, attendees l-r: Jules Epstein-Hebert, Cathi Kim, LES Peoples FCU board member Pia Longarini, Pamela Owens, Cooperative Federal Treasurer Christina Sauve, John Felton CEO of Southern Chautauqua FCU and Cooperative Federal CEO Ron Ehrenreich

About Inclusiv

Inclusiv was instrumental in establishing the CDFI Fund in 1994, is a permanent member of the national CDFI Coalition and is the CDFI and community finance authority for the credit union industry. Our member CDCUs represent over 8 million members in low-income communities across the US, representing the majority of all CDFI-certified credit unions. Today, CDFI certification is an essential credential for credit unions with a focus on financial inclusion. Inclusiv is the credit union industry's best resource for learning more about certification and technical and financial assistance grants. For more information on our advocacy on behalf of CDFI credit unions, click here.

At Inclusiv, we believe that financial inclusion is a fundamental right. We dedicate ourselves to closing the gaps and removing barriers to financial opportunities for people living in distressed and underserved communities. Inclusiv is a certified CDFI intermediary that transforms local progress into lasting national change. We provide capital, make connections, build capacity, develop innovative products and services and advocate for our member community development credit unions (CDCUs). Inclusiv members serve nearly ten million residents of low-income urban, rural and reservation-based communities across the US and hold over $99 billion in community-controlled assets. Founded in 1974, Inclusiv is headquartered in New York, NY, with offices in Madison, WI and Atlanta, GA.