Cathie Mahon Discusses Economic Impact of Community Development Credit Unions with President Bill Clinton at "Economic Inclusion and Growth: The Way Forward"

Panel at conference on domestic economic policy highlights effective models to further progress of CDFIs and promote inclusion

For Immediate Release

Little Rock, AR (November 21, 2019) - At the "Economic Inclusion and Growth: The Way Forward" conference at the Clinton Presidential Center in Little Rock yesterday, Cathie Mahon, Inclusiv President and CEO, shared the role and impact that CDFI credit unions play in stimulating economic growth and financial security in underserved urban and rural communities. The conference brought together leaders and bipartisan representatives to address the continuing need for scalable impact that narrows the income and racial wealth gaps that plague underserved communities. The conference is being held as the Community Development Financial Institutions (CDFI) Fund, created during the Clinton administration, marks its 25th anniversary.

A speaker on the "How Do We Scale the Field" panel moderated by President Bill Clinton, Cathie Mahon said, "The CDFI Fund is one of the Federal government's best market-based strategies for leveraging private dollars. CDFIs leverage $12 of private capital for every $1 of public investment. Investing in CDFIs generates billions of dollars annually in the form of loans to create jobs and grow businesses, build homes, increase job mobility, expand access to affordable healthcare and childcare, and create financial capability to expand consumer purchasing power."

Pictured L to R: Matt Peterson, President and CEO, Los Angeles Cleantech Incubator; Cathie Mahon, President and CEO, Inclusiv; Levar Stoney, Mayor, City of Richmond, Virginia; Gene Ludwig, Founder and CEO, Promontory Financial Group; President Bill Clinton, Founder and Board Chair, Clinton Foundation

Inclusiv, then the National Federation of Community Development Credit Unions, was instrumental in establishing the CDFI Fund, is a permanent member of the national CDFI Coalition, and is a certified CDFI intermediary. The CDFI and community finance authority for the credit union industry, Inclusiv counts the majority of CDFI-certified credit unions among its members. Inclusiv research has established that CDFI credit unions outperform their peers in asset, member and loan growth.

Since signing the Riegle Community Development and Regulatory Improvement Act which established the CDFI Fund in 1994, CDFI Fund awardees have provided more than $29 billion in loans and investments across the US, including $6.1 billion in small towns and rural communities, $757 million in Native communities, and $726 million to women-owned businesses.

Cathie Mahon unveiled details on the newly launched Southern Equity Fund, a partnership between Inclusiv and the Kresge Foundation to address economic insecurity in low-income and communities of color in 17 southern states. The Kresge Foundation is a private, national foundation that builds and strengthens pathways to opportunity for low-income people in America's cities. By using catalytic philanthropic capital in the form of a Program Related Investment (PRI) to serve as a guarantee, Kresge and Inclusiv have leveraged $45 million in senior and subordinate loan capital to invest in high-impact CDFI credit unions in some of the region’s most distressed and persistent poverty areas. Inclusiv and Kresge were joined at the event by two of these pioneering lenders, Bank of America and The National Cooperative Bank.<

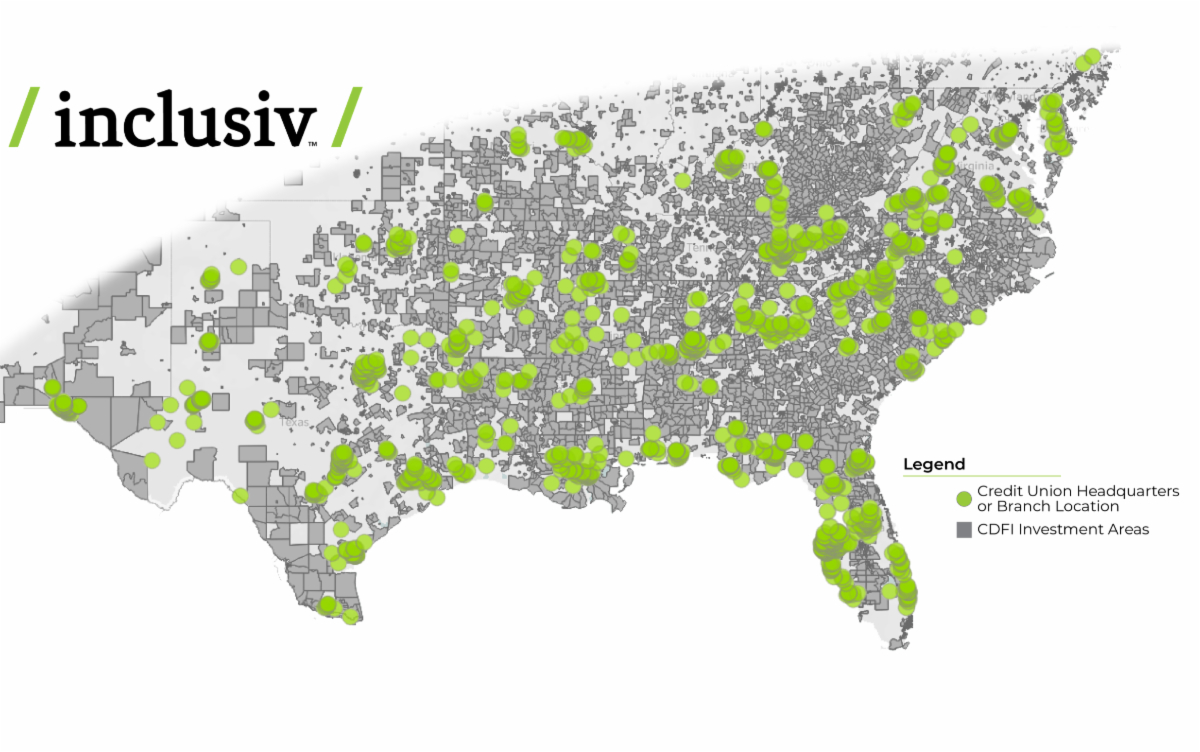

Southern states have the highest concentrations of persistent poverty and the highest concentrations of predatory financial services, including payday lenders. The obstacles to upward economic mobility in low-income communities of color, combined with the prevalence of predatory lenders across many Southern states, underlines the need for equitable financial services in the region and led to the creation of the Inclusiv Southern Equity Fund. According to Inclusiv’s research, the Fund’s prospective credit unions are in the most underserved areas, including CDFI investment areas and persistent poverty counties. (See map below.) The Fund will make investments of up to $5 million in secondary capital loans to high-impact community development credit unions, providing a systems based approach to scale community-based equity building initiatives.

Mahon also shared that CDFI credit unions are leading efforts to build resiliency in their communities which are often most impacted by climate change. Inclusiv recently launched the Center for Resiliency and Affordable Renewable Energy. The Center, created in partnership with the Center for Impact Finance at the Carsey School of Public Policy, University of New Hampshire and the Hewlett Foundation, is designed to build a network of credit unions committed to jointly designing and scaling solutions to climate change, with a goal of promoting affordable and sustainable energy for all people. Severe weather events can have an outsize impact on people and communities least able to withstand them. In the aftermath of recent natural disasters, credit unions have been among the first to open their doors and provide cash to their members even when their own systems were impaired.

The Center's participating credit unions and partners will develop and share best practices in lending to consumers on energy efficient and clean energy solutions such as solar panels and electric vehicles. Also planned is the development of commercial lending opportunities that will help businesses retrofit their facilities with clean energy solutions and stimulate the growth of renewable energy businesses. In addition to the development of clean energy lending programs, the Center will raise and deploy capital to grow lending programs, will conduct research needed to design policy solutions, and will develop and disseminate training programs.

Credit unions interested in learning more about the Inclusiv Southern Equity Fund should contact Cathi Kim, Director, Inclusiv/Capital at ckim@inclusiv.org. Credit unions interested in participating in the Inclusiv Center for Resiliency and Affordable Renewable Energy should contact Pablo DeFilippi, SVP of Membership and Network Engagement, at pablo@inclusiv.org.

###

Media Contact:

Clarissa Ritter

VP, Marketing and Communications

critter@inclusiv.org

About Inclusiv

At Inclusiv, we believe that financial inclusion is a fundamental right. We dedicate ourselves to closing the gaps and removing barriers to financial opportunities for people living in distressed and underserved communities. Inclusiv is a certified CDFI intermediary that transforms local progress into lasting national change. We provide capital, make connections, build capacity, develop innovative products and services and advocate for our member community development credit unions (CDCUs). Inclusiv members serve nearly ten million residents of low-income urban, rural and reservation-based communities across the US and hold over $99 billion in community-controlled assets. Founded in 1974, Inclusiv is headquartered in New York, NY, with offices in Madison, WI and Atlanta, GA. For more information about Inclusiv visit us at Inclusiv.org and connect with us on Facebook , LinkedIn and Twitter.

About Inclusiv/Capital

Inclusiv/Capital is Inclusiv's investment arm, formerly the Community Development Investment Program, and is one of the first and only national lender of secondary capital. Established in 1982, Inclusiv/Capital has invested over $160 million in CDCUs. Inclusiv's Secondary Capital loans have been a catalyst for the double bottom line growth of 81 CDCUs over 22 years. These CDCUs have $16.6 billion in community controlled assets, and have originated $6.7 billion in consumer loans that average $2,800.