Inclusiv Southern Equity Fund

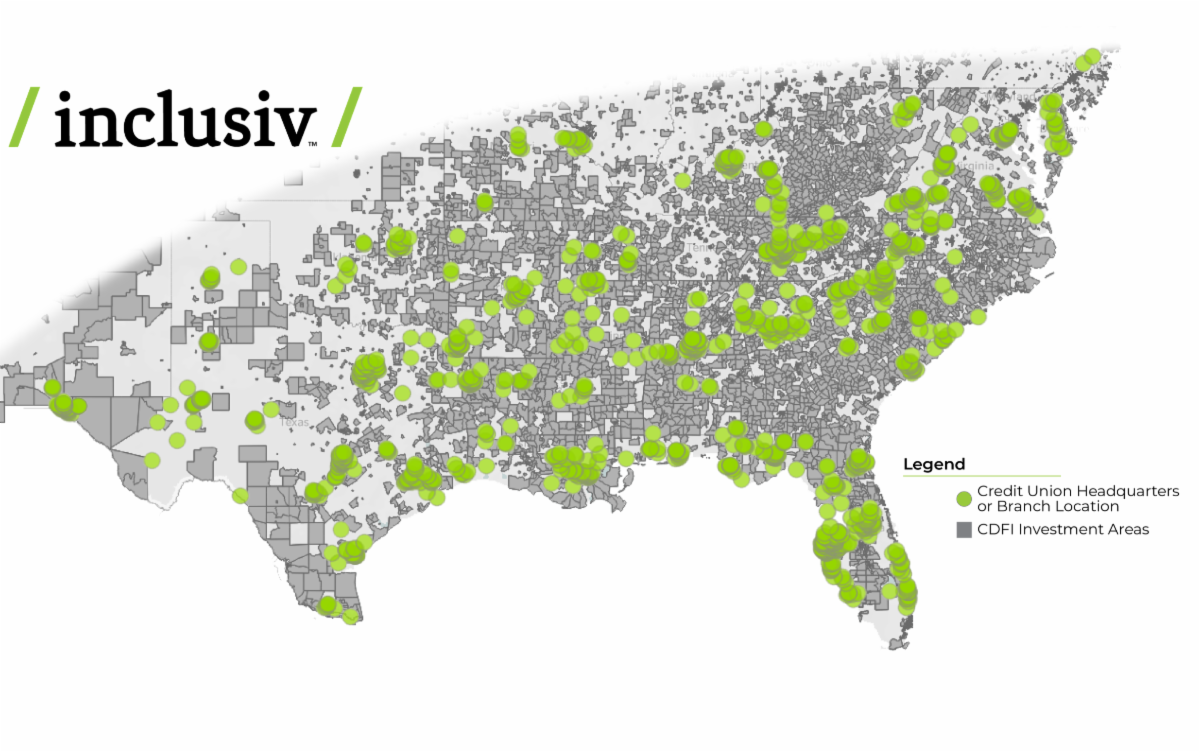

In 2019, Inclusiv/Capital announced the formation of the Inclusiv Southern Equity Fund, a $45 million fund that will invest capital in credit unions serving low-income and communities of color in 17 southern states, including Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, Missouri, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia.

The Challenge

Financial exclusion has been a persistent problem in the South, particularly for communities of color. High cost predatory financial service providers extract billions of dollars in fees and interest from unbanked and underbanked consumers that are better served by credit unions. Inclusiv is delighted to be joined by strongly aligned partners that share our dedication to investing in credit unions to optimize their potential as vehicles for financial inclusion and lasting change in vulnerable communities.

Rampant racial wealth inequality continues to persist in the United States, with 27 percent (67 million people) of the U.S. population unbanked or underbanked. Unbanked and underbanked consumers, those who have no or limited banking relationships, are economically insecure, credit challenged, or live with income volatility. Lack of inclusive financial services is highest in communities of color, with 49% of Hispanics and 45% of African Americans unbanked or underbanked.

Southern states have the highest concentrations of persistent poverty and the highest concentrations of predatory financial services, including payday lenders, check-chasers, and pawnshops. The lack of upward economic mobility in low-income communities of color, combined with the prevalence of predatory lenders in many Southern states, underlines the need for equitable financial services in the region and led to the creation of the Inclusiv Southern Equity Fund.

The Solution

The Inclusiv Southern Equity Fund was designed to promote economic mobility among low wealth and underserved communities, preserve and build diversity in community owned and controlled financial services, and increase the impact of scalable institutions throughout the American South.

The Fund makes investments of up to $5 million in secondary capital loans to high-impact community development credit unions. Inclusiv is the first national lender of secondary capital and uses its resources to amplify the impact of its member Community Development Credit Unions (CDCUs).

The Kresge Foundation, a private, national foundation that builds and strengthens pathways to opportunity for low-income people in America’s cities, joined Inclusiv as a limited partner of the Fund by providing a $5 million equity investment as a credit enhancement for social impact investors.

Inclusiv's investment arm, Inclusiv/Capital, formerly the Community Development Investment Program, is one of the first and only national lender of secondary capital. Established in 1982, Inclusiv/Capital has invested over $160 million in CDCUs. Inclusiv's Secondary Capital loans have been a catalyst for the double bottom line growth of 81 CDCUs over 22 years. These CDCUs have $16.6 billion in community controlled assets, and have originated $6.7 billion in consumer loans that average $2,800.

Inclusiv research finds that credit unions that focus on financial inclusion and community development are more profitable, grow faster and are more active lenders than their peers across the industry. Credit unions interested in learning more about the Inclusiv Southern Equity Fund should contact Cathi Kim, Director, Inclusiv/Capital at capital@inclusiv.org .