IRS Needs Your Help this week regarding issuance of Economic Impact Payments

The information below includes outreach materials and other information that can be shared with your families, friends, partners and clients, posted to your websites, included in your internal newsletters and employee emails and shared on social media. Your assistance is vital in keeping American taxpayers informed and is greatly appreciated.

IRS helps taxpayers and businesses who are affected by the Coronavirus: The IRS has established a special section on IRS.gov focused on steps to help individuals, businesses and other taxpayers affected by the Coronavirus. This page will be updated as new information is available.

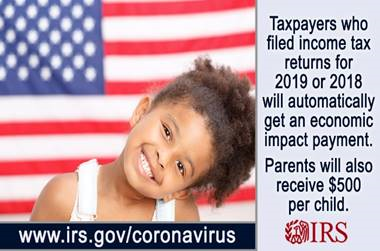

Share information of Economic Impact Payments with your clients and employees: As part of a larger effort to help taxpayers dealing with COVID-19, the IRS has created special informational graphics about the upcoming economic impact payments that can be shared with your employees and clients or posted on your websites. These include details about who qualifies for the $1,200 payments starting soon. For your convenience several graphics have been included at the end of this email. Additional graphics will be available at IRS.gov/coronavirus.

Graphic

Informational e-Posters – 2 pdf files linked below

- e-Poster #1: General information on Economic Impact Payments

- e-Poster #2: Economic Impact Payments – If you still need to file your return

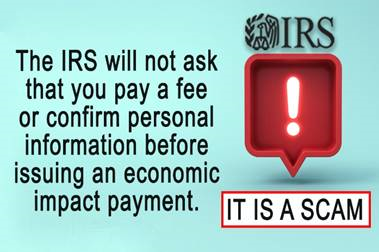

IRS issues warning about Coronavirus-related scams; watch out for schemes tied to economic impact payments: The IRS is urging taxpayers to be on the lookout for an increase of calls and email phishing attempts about the Coronavirus, or COVID-19. Watch for scammers who may:

- Emphasize the words “Stimulus Check” or “Stimulus Payment.” The official term is economic impact payment.

- Ask the taxpayer to sign over their economic impact payment check to them.

- Ask by phone, email, text or social media for verification of personal and/or banking information saying that the information is needed to receive or speed up their economic impact payment.

See the complete April 2, 2020 IRS news release for more information.

Follow IRS on social media, sign up for e-news subscriptions for urgent updates on COVID-19, scams and economic impact payment information

The IRS reminds taxpayers, businesses, tax professionals and others to follow the agency's official social media accounts and email subscription lists to get urgent information on COVID-19 and economic impact payments.

Multilingual Social Media Graphics (All links are in English with the exception of Spanish) – 6 attached

- Content says: IRS is offering coronavirus tax relief. Check for frequent updates.

- Graphics are in English, Spanish, Mandarin Chinese, Korean, Russian and Vietnamese.

The IRS uses several social media tools including:

- Twitter: Taxpayers, businesses and tax professionals can follow the IRS handles for up to the minute announcements, tips and alerts in English and Spanish.

- Facebook: News and information for everybody. Also available in Spanish.

- Instagram: The IRS Instagram account shares taxpayer-friendly information.

- YouTube: The IRS offers video tax tips in English, Spanish and American Sign Language.

- LinkedIn: The IRS shares key agency communications and job opportunities.

Social Media Posts for your use: See the attached word file for additional tweets on Economic Impact Payments, Payment Scams and Charity Scams.

Please use the hashtag: #COVIDreliefIRS

Below are tweets to use with the attached images.

English

Economic Impact Payments: What you need to know www.irs.gov/coronavirus #COVIDreliefIRS

***

Spanish

Pagos de alivio por el impacto económico: lo que debe saber www.irs.gov/es/coronavirus #COVIDreliefIRS

|

|

|

|

|

|

|

|