More than 80 million Economic Impact Payments have already been delivered this week to the nation’s taxpayers. As part of this effort, the IRS has launched two new tools to help taxpayers get their payments:

1. Get My Payment is helping millions of taxpayers. Since its launch yesterday, millions of taxpayers have been able to input their direct deposit information to speed—and track--their payments.

The IRS continues to actively monitor site volume; if the site volume gets too high, users are sent to an online “waiting room” for a brief wait until space becomes available, much like private sector online sites. Media reports saying the tool “crashed” are inaccurate.

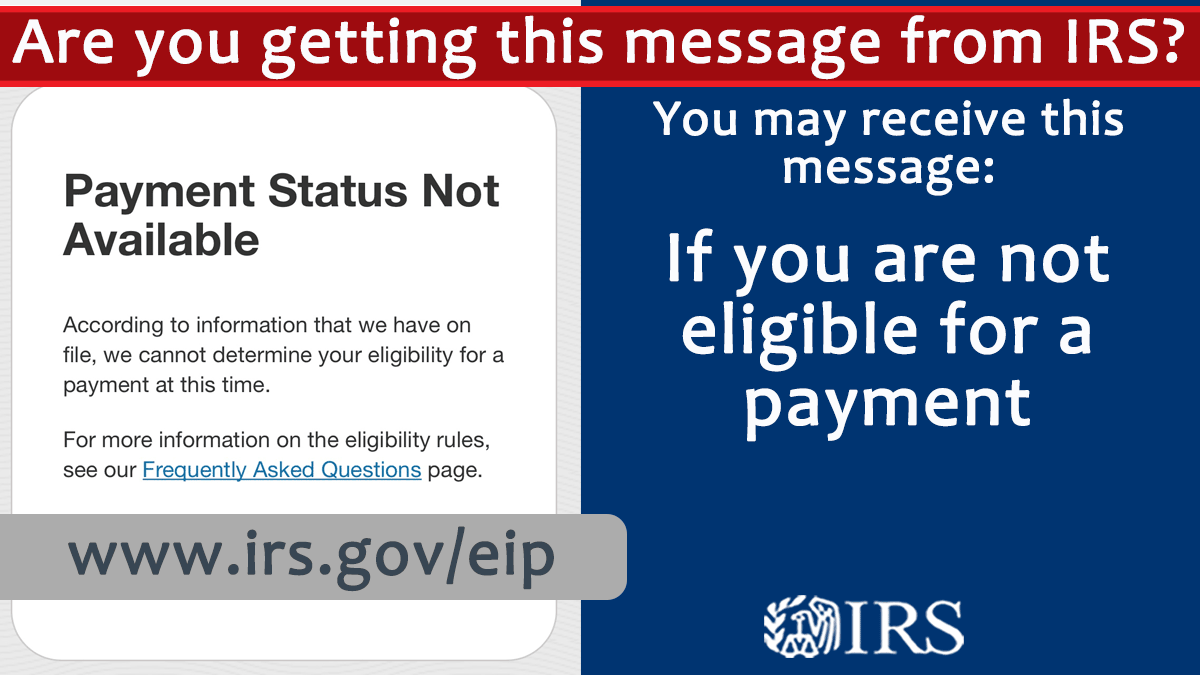

In situations where payment status is not available, the app will respond with “Status Not Available”. The IRS reminds users you may receive this message for one of the following reasons:

- If you are not eligible for a payment (see IRS.gov on who is eligible and who is not eligible)

- If you are required to file a tax return and have not filed in tax year 2018 or 2019.

If you recently filed your return or provided information through Non-Filers: Enter Your Payment Info on IRS.gov. Your payment status will be updated when processing is completed.

- If you are an SSA or RRB Form 1099 recipient, SSI or VA benefit recipient – the IRS is working with your agency to issue your payment; your information is not available in this app yet.

You can check the app again to see whether there has been an update to your information. The IRS reminds taxpayers that Get My Payment data is updated once per day, so there’s no need to check back more frequently.

2. The Non-Filers Enter Payment Info tool since its launch is helping millions of taxpayers successfully submit basic information to receive Economic Impact Payments quickly to their bank accounts. This tool is designed only for people who are not required to submit a tax return.

The IRS is working hard to deliver Economic Impact Payments to all eligible Americans as quickly as possible. These payments are being delivered in record time and in most cases fourteen days of the law being enacted. The IRS is moving aggressively to provide additional information and resolve any issues.

3. Since enactment of the CARES Act there has been a surge of scams involving the Economic Impact Payments resulting in the Treasury Inspector General for Tax Administration (TIGTA) launching the new Coronavirus page to help protect the public.

We appreciate taxpayers’ patience, and we will continue to share information and updates as they become available at IRS.gov/coronavirus.

4. IRS Graphics for Social Media, Web Sites, or E-Newsletters

|

|

|

|

|

5. E-Posters for Flyers, Community/Employee Bulletin Boards, Grocery Store Displays