Inclusiv Southern Equity Fund

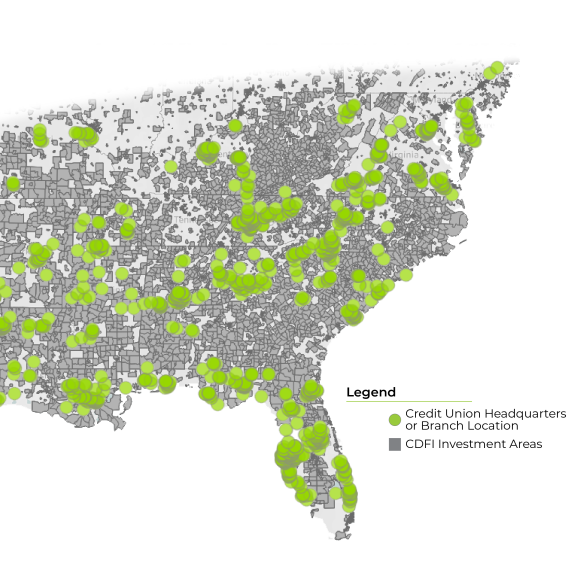

In 2019, Inclusiv/Capital announced the formation of the Inclusiv Southern Equity Fund, a $45 million fund that invested capital in credit unions serving low-income and communities of color in 17 southern states, including Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, Missouri, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia.

The Challenge

Financial exclusion has been a persistent problem in the South, particularly for communities of color. High-cost predatory financial service providers extract billions of dollars in fees and interest from unbanked and underbanked consumers who would be better served by credit unions.

Rampant racial wealth inequality continues to persist in the United States, with 18 percent of the U.S. population unbanked or underbanked. Unbanked and underbanked consumers, people who have no or limited banking relationships, are economically insecure, credit challenged or live with income volatility. Black and Hispanic households are 5 times as likely as white households to be unbanked.

Southern states have the highest concentrations of persistent poverty and the highest concentrations of predatory financial services, including payday lenders, check-cashers, and pawnshops. The lack of upward economic mobility in low-income communities of color, combined with the prevalence of predatory lenders in many Southern states, underlines the need for equitable financial services in the region and led to the creation of the Inclusiv Southern Equity Fund.

The Solution

The Inclusiv Southern Equity Fund was designed to promote economic mobility among low wealth and underserved communities, preserve and build diversity in community-owned and controlled financial services, and increase the impact of scalable institutions throughout the American South.

The Fund is the first impact fund in the credit union industry, mobilizing $45 million from cross-sectoral investors to promote economic opportunity and mobility. The Kresge Foundation, a private, national foundation that builds and strengthens pathways to opportunity for low-income people in America’s cities, joined Inclusiv as a limited partner of the Fund. National Cooperative Bank, Bank of America, MetLife, and Prudential Financial, Inc. are investors in the Inclusiv Southern Equity Fund.

Southern Equity Fund Impact

Community development credit unions participating in the Southern Equity Fund serve more than 646,000 members of uninvested communities across 12 states and represent $8.8 billion in community-based and controlled assets. As of 2023, these credit unions provided: