Share

Border FCU Charts a Path to Financial Empowerment

November 27, 2017

Border Federal Credit Union Charts a Path to Financial Empowerment

[caption id="attachment_12008" align="alignright" width="300"] Border FCU Counseling Team (left to right): Diana Torres, Gina McNeal and Monica Jaquez[/caption]

Border Federal Credit Union, true to its name, sits less than six miles from the Mexican border. Based in Del Rio, Texas, the credit union is reaching individuals and families in remote communities that previously had no access to safe and affordable financial services. At nearly $140 million in assets, Border FCU serves over 25,000 members across 13 rural, low-income counties in Western Texas.

As part of Border’s deep commitment to service, the credit union provides one-on-one financial and housing counseling to their members. Annual member growth at the credit union has been expanding steadily, reaching 2.6 percent at the end of the last quarter of 2017. Their counseling program reaches mostly minority, low-wage workers who often come seeking advice on how to manage their debt or work toward long-term homeownership dreams. The counseling team includes three full-time counselors who provide in-depth counseling to hundreds of individuals and families in their community each year and educational classes to many more. One counselor even travels 60 miles every Tuesday in order to provide this much needed service to BFCU’s Eagle Pass branch, where they eventually hope to add a full time counselor dedicated to serving this area and the surrounding rural, low income communities.

On average, Border provides financial counseling to more than 500 people per year, 98 percent of whom are Latino, two-thirds of whom are female and more than half of whom have an annual household income below $30,000. Most of these counseling clients are also credit challenged, with an average score below 600.

The Need: Tracking Impact

[caption id="attachment_12922" align="alignleft" width="199"]

Border FCU Counseling Team (left to right): Diana Torres, Gina McNeal and Monica Jaquez[/caption]

Border Federal Credit Union, true to its name, sits less than six miles from the Mexican border. Based in Del Rio, Texas, the credit union is reaching individuals and families in remote communities that previously had no access to safe and affordable financial services. At nearly $140 million in assets, Border FCU serves over 25,000 members across 13 rural, low-income counties in Western Texas.

As part of Border’s deep commitment to service, the credit union provides one-on-one financial and housing counseling to their members. Annual member growth at the credit union has been expanding steadily, reaching 2.6 percent at the end of the last quarter of 2017. Their counseling program reaches mostly minority, low-wage workers who often come seeking advice on how to manage their debt or work toward long-term homeownership dreams. The counseling team includes three full-time counselors who provide in-depth counseling to hundreds of individuals and families in their community each year and educational classes to many more. One counselor even travels 60 miles every Tuesday in order to provide this much needed service to BFCU’s Eagle Pass branch, where they eventually hope to add a full time counselor dedicated to serving this area and the surrounding rural, low income communities.

On average, Border provides financial counseling to more than 500 people per year, 98 percent of whom are Latino, two-thirds of whom are female and more than half of whom have an annual household income below $30,000. Most of these counseling clients are also credit challenged, with an average score below 600.

The Need: Tracking Impact

[caption id="attachment_12922" align="alignleft" width="199"] Border FCU CEO Maria Martinez, pictured with her 2017 Herb Wegner Memorial Award for Outstanding Individual Achievement from the National Credit Union Foundation.[/caption]

In 2014 Border sought to address a common challenge shared by the majority of counseling program providers: how to measure success. An analysis of 5300 reports showed that 75 percent of CDFI certified and 35 percent of LID designated credit unions offer some type of financial counseling. However, the outcomes of counseling are not captured. Based on a survey of its member institutions, the Federation also concluded that 62 percent of credit unions that offer counseling are not tracking the results of these financial counseling services.

While Border FCU recognized the importance of providing one-to-one financial counseling and financial education, the credit union still had no real way of precisely measuring the impact of their counseling program or a tool for tracking individual members’ financial health over time.

Many of BFCU’s loan products target underserved customers – including two of their most popular, the Second Chance Auto Financing loans for credit challenged consumers and the Occupational Loan, which is offered regardless of credit to Border members who can show proof of steady employment and consistent income – incorporate financial counseling requirements before and during the life of the loan. The member must show improved creditworthiness over time in order for Border to renew or refinance the loan. This requirement – and its direct impact on rates of loan product uptake – in part reflects Border’s belief that the delinquency rate and loan denial rate is considerably lower for those members that attend financial counseling. However, without adequate data this assumption had remained untested until now.

Another concern at the time was that, although Border FCU had continued to provide financial counseling services, in recent years the credit union had not received enough funding to cover program costs. Operating under the belief that financial counseling has a positive effect on the credit union’s bottom line, the reality was that without the ability to track effectiveness, making the case for funding could be a challenge.

Ultimately, staff and management wanted to track the overall financial improvement of members – budgeting, credit worthiness, debt management, asset building, etc. – to see the improvement the client has had over time. They wanted their clients to not only improve their financial well-being but also to increase their assets through savings. The introduction of Pathways to Financial Empowerment provided a path toward meeting these objectives.

The Solution: Pathways to Financial Empowerment

Border FCU CEO Maria Martinez, pictured with her 2017 Herb Wegner Memorial Award for Outstanding Individual Achievement from the National Credit Union Foundation.[/caption]

In 2014 Border sought to address a common challenge shared by the majority of counseling program providers: how to measure success. An analysis of 5300 reports showed that 75 percent of CDFI certified and 35 percent of LID designated credit unions offer some type of financial counseling. However, the outcomes of counseling are not captured. Based on a survey of its member institutions, the Federation also concluded that 62 percent of credit unions that offer counseling are not tracking the results of these financial counseling services.

While Border FCU recognized the importance of providing one-to-one financial counseling and financial education, the credit union still had no real way of precisely measuring the impact of their counseling program or a tool for tracking individual members’ financial health over time.

Many of BFCU’s loan products target underserved customers – including two of their most popular, the Second Chance Auto Financing loans for credit challenged consumers and the Occupational Loan, which is offered regardless of credit to Border members who can show proof of steady employment and consistent income – incorporate financial counseling requirements before and during the life of the loan. The member must show improved creditworthiness over time in order for Border to renew or refinance the loan. This requirement – and its direct impact on rates of loan product uptake – in part reflects Border’s belief that the delinquency rate and loan denial rate is considerably lower for those members that attend financial counseling. However, without adequate data this assumption had remained untested until now.

Another concern at the time was that, although Border FCU had continued to provide financial counseling services, in recent years the credit union had not received enough funding to cover program costs. Operating under the belief that financial counseling has a positive effect on the credit union’s bottom line, the reality was that without the ability to track effectiveness, making the case for funding could be a challenge.

Ultimately, staff and management wanted to track the overall financial improvement of members – budgeting, credit worthiness, debt management, asset building, etc. – to see the improvement the client has had over time. They wanted their clients to not only improve their financial well-being but also to increase their assets through savings. The introduction of Pathways to Financial Empowerment provided a path toward meeting these objectives.

The Solution: Pathways to Financial Empowerment

In 2015, Border became one of the first credit unions to pilot the Pathways to Financial Empowerment model and platform. The Pathways initiative, developed by the National Federation of Community Development Credit Unions and Neighborhood Trust Financial Partners, integrates counseling with high-impact financial products to help members reach their financial goals. Pathways utilizes a standardized platform to help evaluate members’ progress toward improved credit, manageable debt levels, and short and long-term savings.

Pathways enables credit unions like Border to track outcomes and measure success through simple, consistent measures, and promote appropriate financial products and services through financial counseling by helping people to access the right services to move forward financially.

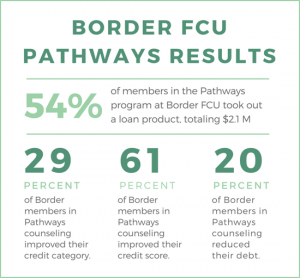

In its first year of implementation, Border served over 500 people using the Pathways platform, enabling the credit union to better understand clients’ initial financial condition in a “Financial Snapshot” and establish detailed, individualized plans for how to move forward, through “Take Action Today” steps. Over the same period, Pathways participants opened nearly 400 products at BFCU after their initial counseling session, including 306 loans, totaling $2.1 million.

The Pathways program has been highly effective in helping Border FCU members achieve financial action steps, establish or improve their credit, build savings, and decrease debt.

“We’re finding real success with the Pathways program,” Border FCU Chief Executive Officer Maria Martinez said. “Implementing Pathways has allowed us to effectively track our financial counseling work, gain a clearer sense of a client’s financial health over time and measure the lasting impact these counseling services have on overall financial well-being for our members.”

Utilizing the Pathways platform, BFCU was able to demonstrate its impact in pairing financial products with education, ultimately boosting the financial health of its diverse and growing membership. Among the year-one clients for whom follow-up credit reports were pulled during the pilot, 40 percent reduced their debt and 14 percent improved their credit category. Of those who came to counseling “unscorable,” 50 percent established credit by the end of the pilot.

The Path Forward: Future Opportunities and Enhancements

[caption id="attachment_12924" align="alignleft" width="300"]

In 2015, Border became one of the first credit unions to pilot the Pathways to Financial Empowerment model and platform. The Pathways initiative, developed by the National Federation of Community Development Credit Unions and Neighborhood Trust Financial Partners, integrates counseling with high-impact financial products to help members reach their financial goals. Pathways utilizes a standardized platform to help evaluate members’ progress toward improved credit, manageable debt levels, and short and long-term savings.

Pathways enables credit unions like Border to track outcomes and measure success through simple, consistent measures, and promote appropriate financial products and services through financial counseling by helping people to access the right services to move forward financially.

In its first year of implementation, Border served over 500 people using the Pathways platform, enabling the credit union to better understand clients’ initial financial condition in a “Financial Snapshot” and establish detailed, individualized plans for how to move forward, through “Take Action Today” steps. Over the same period, Pathways participants opened nearly 400 products at BFCU after their initial counseling session, including 306 loans, totaling $2.1 million.

The Pathways program has been highly effective in helping Border FCU members achieve financial action steps, establish or improve their credit, build savings, and decrease debt.

“We’re finding real success with the Pathways program,” Border FCU Chief Executive Officer Maria Martinez said. “Implementing Pathways has allowed us to effectively track our financial counseling work, gain a clearer sense of a client’s financial health over time and measure the lasting impact these counseling services have on overall financial well-being for our members.”

Utilizing the Pathways platform, BFCU was able to demonstrate its impact in pairing financial products with education, ultimately boosting the financial health of its diverse and growing membership. Among the year-one clients for whom follow-up credit reports were pulled during the pilot, 40 percent reduced their debt and 14 percent improved their credit category. Of those who came to counseling “unscorable,” 50 percent established credit by the end of the pilot.

The Path Forward: Future Opportunities and Enhancements

[caption id="attachment_12924" align="alignleft" width="300"] Border FCU staff celebrating Cinco de Mayo.[/caption]

Building upon this success, Border FCU has continued to actively participate in the Pathways program and dramatically increase both the impact and reach of their counseling services, counseling more than 1,000 clients throughout 2017 under the Pathways model

Over the same period, 20 percent of Border members in Pathways reduced their debt. Additionally, 61 percent improved their credit score and 29 percent improved their credit category. Members in counseling also saw significant reductions in collections and judgments, with a 61 percent and 53 percent decrease, respectively.

Border FCU is a Juntos Avanzamos designated credit union, affirming its commitment to serving and empowering Hispanic and immigrant consumers – helping them navigate the U.S. financial system and providing safe, affordable and relevant financial services. Juntos Avanzamos credit unions employ bilingual, culturally-competent staff and leadership, accept alternative forms of ID and treat all of their members with respect, regardless of immigration status. Based on its membership demographic, the need for approachable, personalized and Hispanic-friendly products, services and staff had been an essential feature of Border’s counseling program long before their Juntos Avanzamos designation, given that roughly 98 percent of those seeking BFCU’s financial counseling services are Hispanic. As of February 2018, the Pathways platform has Spanish-language functionality for text messaging, financial snapshots and action plans. With this new functionality in place, counselors at credit unions like BFCU are now able to further enhance financial counseling services and improve outcomes for bilingual and Spanish dominant speakers through more effective engagement with and better integration of the Pathways model.

Implementing Pathways allows BFCU financial counselors to add an additional layer of counseling opportunities by leveraging a feature likely to appeal to this group: utilizing SMS text messages to send members periodic “Take Action Today” alerts. These alerts serve as a soft “nudge” prompting the client to complete quick, actionable steps that a counselor has helped them identify as part of their personalized financial well-being improvement plan. A significant amount of research, including studies conducted by groups like Pew Research Center and Neilson, indicates that Hispanic consumers report a strong preference for and heavy reliance upon mobile communication, with Latino consumers leading overall rates of mobile use in the U.S., compared to other groups.

Border FCU has further expanded its specialized offerings for Hispanic consumers and expanded the reach of their financial counseling program by opening the Ventanilla de Asesoría Financiera (or “Financial Counseling Window”), to help Mexican nationals establish their financial footprint in the United States. The Ventanilla officially launched in September 2017, providing financial assistance to Mexican immigrants through in-person counseling with a BFCU counselor in a safe and secure space in the consulate office. Utilizing Pathways, Border is able to seamlessly track counseling activities, financial well-being and impact for all counseling participants, across multiple points of contact and locations where services are delivered, regardless of how an individual’s relationship to the BFCU financial counseling program, to the Ventanilla or to credit union membership may evolve and grow over time.

For more information on the Pathways to Financial Empowerment program and platform, please visit cdcu.com/pathways or contact Michelle Parker, Program Officer, at mparker@inclusiv.org to learn more.

Border FCU staff celebrating Cinco de Mayo.[/caption]

Building upon this success, Border FCU has continued to actively participate in the Pathways program and dramatically increase both the impact and reach of their counseling services, counseling more than 1,000 clients throughout 2017 under the Pathways model

Over the same period, 20 percent of Border members in Pathways reduced their debt. Additionally, 61 percent improved their credit score and 29 percent improved their credit category. Members in counseling also saw significant reductions in collections and judgments, with a 61 percent and 53 percent decrease, respectively.

Border FCU is a Juntos Avanzamos designated credit union, affirming its commitment to serving and empowering Hispanic and immigrant consumers – helping them navigate the U.S. financial system and providing safe, affordable and relevant financial services. Juntos Avanzamos credit unions employ bilingual, culturally-competent staff and leadership, accept alternative forms of ID and treat all of their members with respect, regardless of immigration status. Based on its membership demographic, the need for approachable, personalized and Hispanic-friendly products, services and staff had been an essential feature of Border’s counseling program long before their Juntos Avanzamos designation, given that roughly 98 percent of those seeking BFCU’s financial counseling services are Hispanic. As of February 2018, the Pathways platform has Spanish-language functionality for text messaging, financial snapshots and action plans. With this new functionality in place, counselors at credit unions like BFCU are now able to further enhance financial counseling services and improve outcomes for bilingual and Spanish dominant speakers through more effective engagement with and better integration of the Pathways model.

Implementing Pathways allows BFCU financial counselors to add an additional layer of counseling opportunities by leveraging a feature likely to appeal to this group: utilizing SMS text messages to send members periodic “Take Action Today” alerts. These alerts serve as a soft “nudge” prompting the client to complete quick, actionable steps that a counselor has helped them identify as part of their personalized financial well-being improvement plan. A significant amount of research, including studies conducted by groups like Pew Research Center and Neilson, indicates that Hispanic consumers report a strong preference for and heavy reliance upon mobile communication, with Latino consumers leading overall rates of mobile use in the U.S., compared to other groups.

Border FCU has further expanded its specialized offerings for Hispanic consumers and expanded the reach of their financial counseling program by opening the Ventanilla de Asesoría Financiera (or “Financial Counseling Window”), to help Mexican nationals establish their financial footprint in the United States. The Ventanilla officially launched in September 2017, providing financial assistance to Mexican immigrants through in-person counseling with a BFCU counselor in a safe and secure space in the consulate office. Utilizing Pathways, Border is able to seamlessly track counseling activities, financial well-being and impact for all counseling participants, across multiple points of contact and locations where services are delivered, regardless of how an individual’s relationship to the BFCU financial counseling program, to the Ventanilla or to credit union membership may evolve and grow over time.

For more information on the Pathways to Financial Empowerment program and platform, please visit cdcu.com/pathways or contact Michelle Parker, Program Officer, at mparker@inclusiv.org to learn more.