Share

CDCUs Help Borrowers Escape Predatory Lending Trap

March 20, 2018

CDCUs Help Borrowers Escape the Predatory Lending Trap

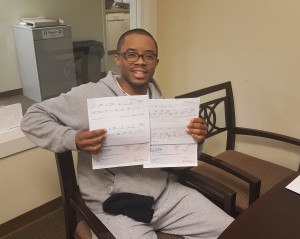

Lawrence, an Atlanta-based healthcare professional, came to 1st Choice Credit Union in financial distress after borrowing from a predatory lender, notorious for targeting minority communities.

Lawrence is very dependent on his car for work, but high interest rates and fees on his auto loan added up, and eventually he owed $2,000 more than the car was worth. He also had a personal loan with a 35 percent interest rate and several credit cards.

Unlike the predatory lender, which offered to “help” with more high-interest loans, 1st Choice Credit Union cut Lawrence’s interest rates in half with a refinanced car loan and a personal loan to offset the negative equity – ultimately reducing his debt payments by more than $300 each month!

“This credit union has really saved my life!” says Lawrence.

Lawrence, an Atlanta-based healthcare professional, came to 1st Choice Credit Union in financial distress after borrowing from a predatory lender, notorious for targeting minority communities.

Lawrence is very dependent on his car for work, but high interest rates and fees on his auto loan added up, and eventually he owed $2,000 more than the car was worth. He also had a personal loan with a 35 percent interest rate and several credit cards.

Unlike the predatory lender, which offered to “help” with more high-interest loans, 1st Choice Credit Union cut Lawrence’s interest rates in half with a refinanced car loan and a personal loan to offset the negative equity – ultimately reducing his debt payments by more than $300 each month!

“This credit union has really saved my life!” says Lawrence.